Sony Music and UMG Battle To Gain Market Value in China, via Tencent

Ultimately in the hands of one of China’s largest players, Universal and Sony are battling hand-in-hand as Tencent’s next favourite by pulling out some of their largest cards to woo China.

Ultimately in the hands of one of China’s largest players, Universal and Sony are battling hand-in-hand as Tencent’s next favourite by pulling out some of their largest cards to woo China.

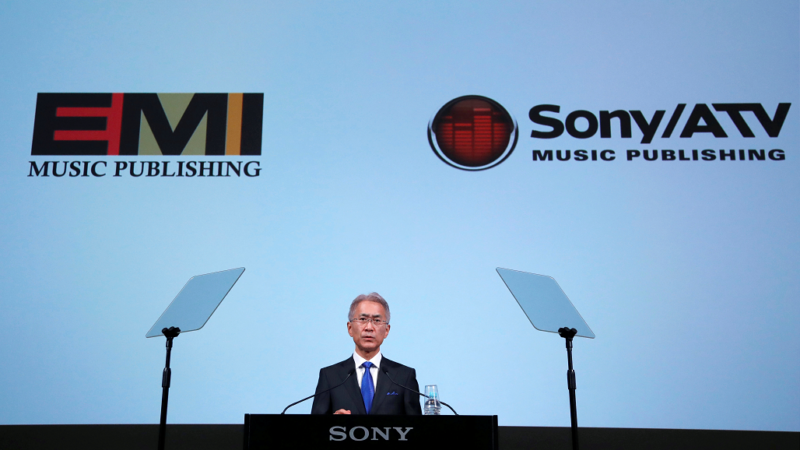

Breaking News: Sony Corp to offer around $2.3billion to gain control of EMI, an "investment in content intellectual property".

It’s probably obvious by now that China has become the new focus by some of the world’s largest music labels and publishers. When the industry was just discussing the potential of the music industry in China a decade ago, its reality is fast approaching and is not only making a huge impact for outsiders breaking in to the Chinese market, but also producing a pool of homegrown talents, attracting foreign interest and investment, and streamlining China as the next creative hub.

In less than 9 months between, Universal and Sony have both made significant headlines with Tencent Music Entertainment; signing strategic agreement to distribute licensed music, build a world class recording studio [Universal], to launching electronic Asia-based music label Liquid State [Sony] – all via tech giant Tencent Music Entertainment [TME], which currently runs China’s largest music service providers including QQ Music, KuGou and Kuwo. Tencent Music. Unlike Spotify, TME is already profitable in part as a music provider because it owns the rights to much of the Chinese repertoire that it plays.

However, breaking in to China may set up a whole new set of challenges altogether. In August 1 this year, Vivendi announced its plan to sell half of its most prized flagship record company – almost 60% of UMG’s shares. As a result, it pushed the French media company’s shares up by 3.7% at the Paris stock exchange. It may also signify Vivendi’s plan to focus its business within Europe and the U.S., and collect steady returns, before UMG’s further investing plans for its new territory, China.

Apart from announcing its plan to license its music and publishing catalogues to Facebook, Instagram and Oculus last December, UMG play technology catch up when it launched a pilot programme – Auddly – that offers song data management powered by a ‘unique’ metadata identifier to help sync and match credits and payment. 6 months later, Sony-owned BMG, together with Warner, Outdustry, Phoenix Music International and Global Music Rights were announced as pilot participants of KORD, a blockchain network aimed at operating “a permisionless, decentralized network of intellectual property information, allowing rights holders to collaborate on an industry-wide view of rights.”

Last April, Universal Music China showed further interest in expanding its Chinese presence by signing one of China’s most recent superstar Kris Wu. Partnering with UMG’s very own Interscope Geffen A&M and Island Records UK, Kris Wu’s deal came after he became the first Chinese artist to reach No. 1 on the U.S iTunes and No. 29 on Billboard’s Emerging Artists chart.

It’s obvious that Sony has its own of accolades when it comes to global monopoly; boasting a line of international artists including Mark Ronson, Pharrell Williams,Foo Fighters, Skrillex; specifically mentioning Asia-based artists including Vanness Wu, Agnez Mo, F4, Faye Wong, Misha Omar, Rita Ora, and Slot Machine. Fast forward to July this year, Sony announced that it has signed Karen Mok, one of Hong Kong and Taiwan’s most popular hip hop/pop artist, and first Hong Kong artist to win the Golden Melody Awards.

In June 2017, Sony also announced the merging of its two independent distribution companies The Orchard and Red Essential.

Proving that revenues and profits are not what a growing music company should only be focusing on, Sony Music announced a line of new promotions in Asia and the surrounding region via Denis Handline AO, President of Sony Music for Asia-Pacific. Among others, they include new GM, Media Strategy & Business Development (ANZ & Asia) – Dan Nitschke; new GM, Communications & Artist Relations and VP, TV Entertainment (APAC) – Grant Donges; and new Director, National Communications & Artist Relations (Asia) – Therese Ryan.

While Universal was indeed a larger company when it comes to recorded music on a global scale, Sony’s ‘music’ activity turned over $6.9bn, while UMG turned over $6.4bn in 2017. And so, in corporate terms, Sony is the biggest music company, globally.

Last year, UMG’s long-list of genre-specific labels saw a huge increase of $503m in revenue , with streaming revenues reported an increase of $581m, which brought in a total of over $5bn just for recorded music. Meanwhile, Sony’s equivalent figure stood at $3.85bn, their labels reported a rise of $206m in recorded music sales last year.

Universal Music Group sign Kris Wu in April, 2018 as part of its plan to gain market value in China.

While both companies stream their revenue appropriation quite differently, they are constantly renewing their games, film and music facilities and services to bring in larger revenues. One such ‘new’ division is Sony’s Visual Media & Platform, a division that produces and distributes app-based animation titles for its newest video game. According to Sony, this division offers ‘various service offerings for music and visual products’. It is still unclear as to why Sony Corp would appropriate this division as part of its ‘Music’ rather than its ‘Game & Network Services’ division.

In the full year leading up to March 31, 2018, Sony Corp reported total revenue of roughly $78.1 billion, all of which came from a diverse investment in gaming, mobile, tech and music industry. $1.62bn came from the PlayStation business alone; selling over 247m games in 2017 alone, and 76m PS4s to date. While Universal do not have its own gaming division to date, it did begin Universal Interactive before undergoing a merger with Vivendi in year 2000. It gradually went under Vivendi Universal Publishing before finally disappearing from gaming altogether in 2006.

As you can see, it’s probably not a leveled field to begin with. China isn’t so new to Sony’s mobile and gaming products, and while there may be a few useful strings to pull, in parent corporate terms, it has growing contenders in the market made up, non-exclusively, of China’s very own homegrown creative entities, but also international brands hoping to snap a piece from China’s growing interest from the West.

Totally in its own league, Tencent has set a path to creating an international brand for itself, prior to being an established tech company. As it continues to diversify its business into film and music, mirroring the success of Universal and Sony in its home turf, while clearly realising as acting gatekeeper for China’s thriving music business.

While Sony and Universal may still show its revenues and profits in a global perspective, China, no doubt, is the game changer for the music business in Asia and the world, driven by technological advancement in big data and AI, volume of its population, new and almost non-existent laws concerning licensing and copyright, coupled with a booming economy and huge foreign interest.