Tencent Bid To Expand Gaming Outside China And Gain Foothold In Cryptocurrency Industry

Tencent might soon be the proud owner of two major bitcoin exchanges, as the $400 billion Chinese tech conglomerate is weighing a bid for the South Korean holding company that controls them.

Tencent might soon be the proud owner of two major bitcoin exchanges, as the $400 billion Chinese tech conglomerate is weighing a bid for the South Korean holding company that controls them.

Tencent's Shenzhen office

Tencent Mulling Bid for Owner of Bitstamp & Korbit

Reuters reports that Tencent is actively pursuing co-investors to purchase the South Korea-based NXC Corp, the company behind gaming firm Nexon. Kim Jung-ju reportedly wants to sell a 98.64 percent share in the company that he co-founded in 1994. That stake, which is held by Kim and his wife, is worth an estimated $7.1 billion to $8.9 billion.

Though best known for its gaming empire, NXC owns multiple cryptocurrency exchanges. In late 2017, the firm acquired a majority stake in Korbit — then South Korea’s second-largest crypto exchange — in a deal that valued the company at $150 million. Korea’s crypto market has undergone significant turbulence in year-and-a-half since that acquisition, but Korbit retains a solid presence in the region with an estimated $350 million in monthly trading volume.

Last October, NXMH — NXC’s Belgian subsidiary — purchased an 80 percent stake in Bitstamp, the world’s oldest bitcoin exchange. Bitstamp currently ranks as a top-50 exchange with a monthly volume of more than $1.8 billion.

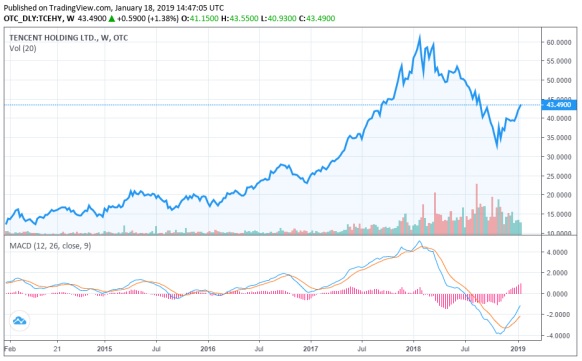

Tencent has lost more than $160bn in market value from its peak in January 2018, chiefly on regulatory uncertainty, and now trails arch rival Alibaba Group to be Asia’s second-biggest listed company by market capitalisation.

Purchase Would Give Tencent Foothold in Crypto Industry

Given the state of the cryptocurrency market, it’s unlikely that Nexon’s crypto ventures will play much of a role in Tencent’s decision about whether to acquire the company. Rather, the potential acquisition most likely stems from Tencent’s desire to expand its gaming business outside of China where tightening regulation has been a thorn in its side — and its share price, which sits well below its all-time high.

Concerned about the prevalence of gaming addiction, China has severely curtailed game approvals in recent months. Authorities began to green light a limited number of new games this month, but Tencent’s offerings have been notably absent from the approval list.

Nevertheless, an NXC purchase would give Tencent a foothold in the cryptocurrency industry, providing it with the ability to quickly expand its reach into this nascent sector if it ever had the inclination. As CCN reported, Tencent has already invested significant capital in blockchain projects, including forming a partnership with a blockchain esports entertainment platform.

The article above was first published by CCN.com, authored by Josiah Wilmoth on January 18,2019 titled ‘How $400 billion Tencent Might Soon Acquire Two Major Bitcoin Exchanges’.